Developing A Financial Plan

Creating a financial plan helps you see the big picture and set long and short-term life goals, a crucial step in mapping out your financial future. When you have a financial plan, it’s easier to make financial decisions and stay on track to meet your goals. Working with Timothy Parros allows him to see your entire picture, while helping to create financial confidence and help you reach your planning goals.

Creating a financial plan helps you see the big picture and set long and short-term life goals, a crucial step in mapping out your financial future. When you have a financial plan, it’s easier to make financial decisions and stay on track to meet your goals. Working with Timothy Parros allows him to see your entire picture, while helping to create financial confidence and help you reach your planning goals.

Here are some additional things to consider:

- Do you want to better manage your finances, but aren’t sure where to start

- You don’t have time to do your own financial planning

- You want a professional opinion about the plan you’ve developed

- You may not have any or sufficient expertise in certain areas such as investments, insurance, taxes or retirement planning

- You, or a loved one, might have an immediate need or unexpected life event

- You have some large expenses that you are considering such as purchasing a home, paying for school or college for your kids, your parents are in need of assistance, the list is unending and you want to be prepared

There are no guarantees in life but we believe people with a financial plan worry less and save more.

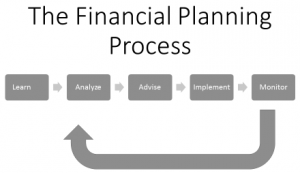

Our process is simple, during the two to three weeks following our initial meeting we will review all the information collected and the documents provided to fully understand your current situation. Then we will make specific recommendations relating to each of the financial and life goals you identified and summarize our findings in a Financial Plan.

We then schedule a second meeting and at this time we will walk through each part of your plan covering each goal and the accompanying recommendations. The meeting is very interactive and we will take all the time needed to answer your questions – ensuring you understand your plan is essential.